|

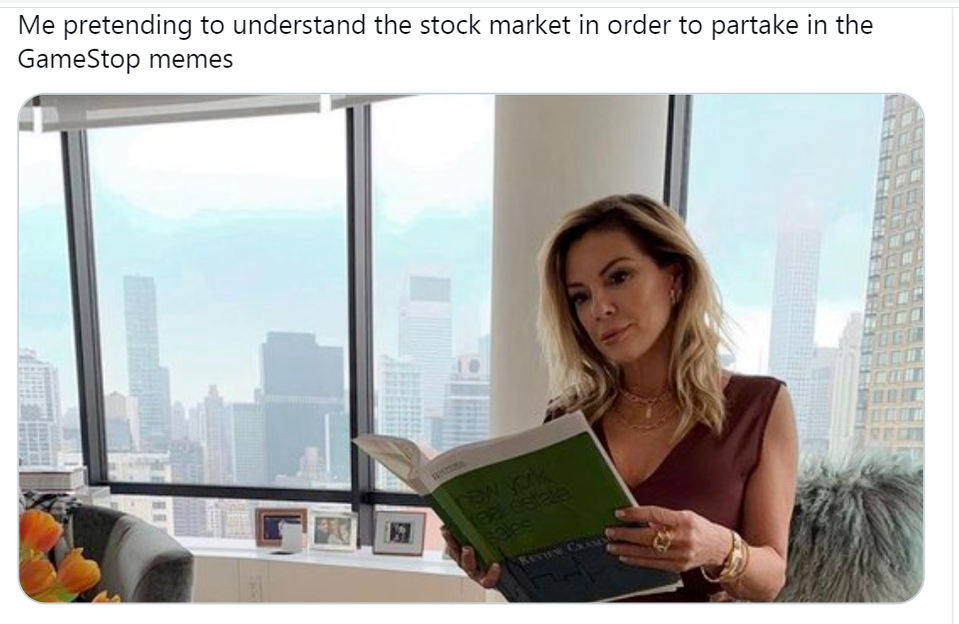

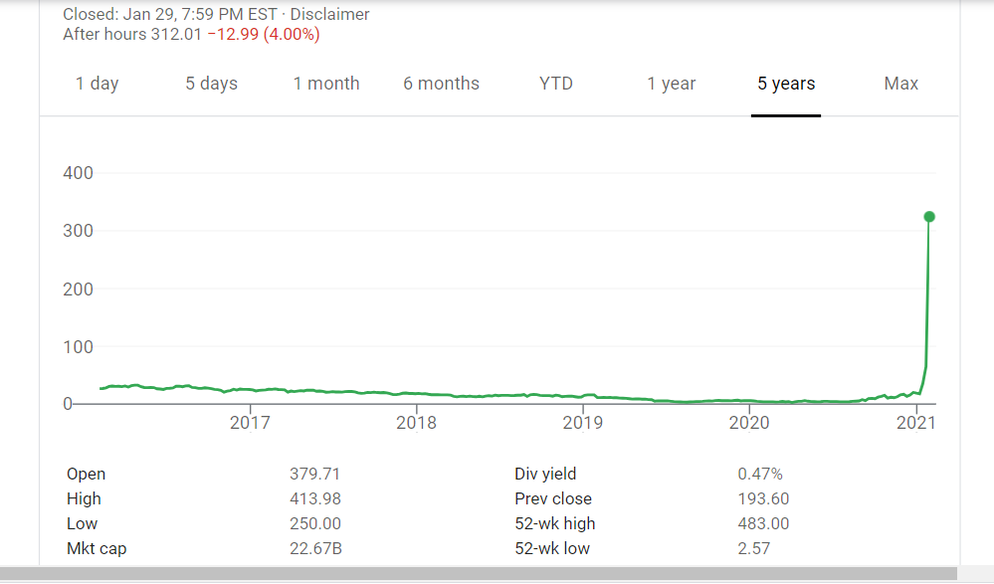

"Equal and Opposite Reactions" http://amzn.to/2xvcgRa and the sequel, "Hail Mary" https://www.amzn.com/1684334888 Buy them on Amazon. EVERYTHING YOU DON'T UNDERSTAND ABOUT THE GAMESTOP THING EXPLAINED BY SOMEBODY WHO PROBABLY UNDERSTANDS IT LESS I freely admit that I am probably among that segment of the population which bobs on the low end of the stock market IQ spectrum. However this status generally creates no real problem for me as neither my mate nor myself have ever in our lives owned a share of stock, ...and likely never will between now and the day we cross over the Rainbow Bridge. In truth, it's only been within the past five days, since the GameStop saga has come to the foreview, that I've found myself at something of a disadvantage. But after a bit of self-education I now get the general idea of the GameStop event that went down last week. As I understand it - or think I do, in the broadest terms - the big-potatoes rich Wall Street hedge fund investors (aka those who didn't need their government stimulus checks) who had been in the process of manipulating GameStop stock in order to make it lose money for a profit for themselves - shorting, as this tactic is called - lost a ton of money collectively, while the small-potatoes amateur traders (aka those who did need their government stimulus checks), using a phone app called Robinhood, joined together, bought up huge shares of GameStop, drove up the price of the company's stock, and made a ton of money collectively while sticking it to the rich hedge fund short-stocking investors, the sticking-it-to-the-rich aspect of the deal apparently being more the point than the money made. Or, as this meme so succinctly illustrates it: So then, in a nutshell, the GameStop ploy caused the Wall Street Hedge fund investors to lose money on GameStop and the Robinhood investors to make money on GameStop. The only player that seems unaffected by the event is...GameStop. The company was apparently on the verge of going out of business, which is why, though its stocks were worth only a few dollars a share, the Wall Street hedge funders were forcing its price even lower. But by the time the Robinhood traders had bought up the stock it was worth over $400 a share, as illustrated in this graph of the GameStop stock trajectory: But the company itself is still on the verge of going out of business: that is to say, nobody has suddenly been high-tailing it to the GameStop stores to buy up its wares and generate more income for the GameStop company, its owners, vendors, and employees. Because apparently nobody really wants GameStop's wares, no matter how much its stock is worth. Which begs the question: All right, I guess I don't even know what the question it begs is. Okay, maybe the question goes something like this: Can a thing that doesn't really exist generate and lose money? Or is that what the whole stock-market-investing-hedge-fund-trading thing is really all about? Beats me. Stay tuned: Tomorrow (aka next time) I'll explain everything I likewise don't understand about shorting stocks. References:

https://www.fool.com/investing/how-to-invest/stocks/how-to-short-stock/#:~:text=When%20you%20sell%20the%20stock,some%20time%20in%20the%20future. https://www.investopedia.com/articles/investing/102113/what-are-hedge-funds.asp#:~:text=Hedge%20funds%20are%20financial%20partnerships,leverage%20to%20generate%20higher%20returns.

0 Comments

Leave a Reply. |

"Tropical Depression"

by Patti Liszkay Buy it on Amazon: https://www.amazon.com/dp/B0BTPN7NYY "Equal And Opposite Reactions"

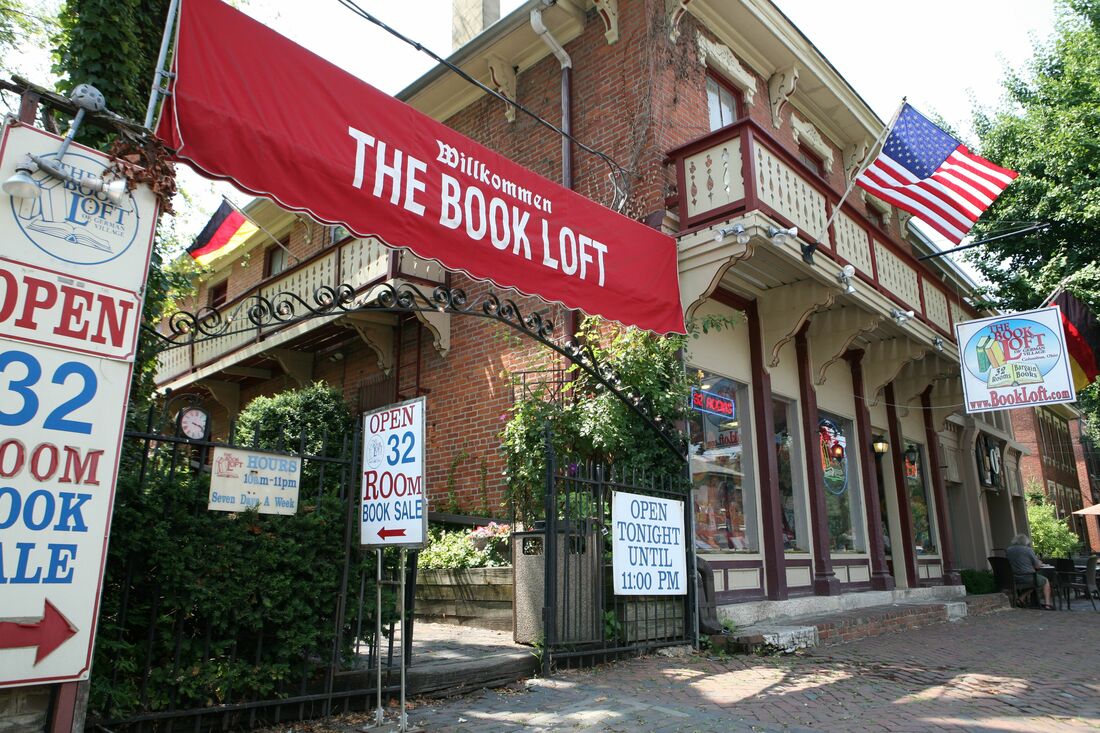

by Patti Liszkay Buy it on Amazon: http://amzn.to/2xvcgRa or from The Book Loft of German Village, Columbus, Ohio Or check it out at the Columbus Metropolitan Library

Archives

July 2024

I am a traveler just visiting this planet and reporting various and sundry observations,

hopefully of interest to my fellow travelers. Categories |

RSS Feed

RSS Feed