|

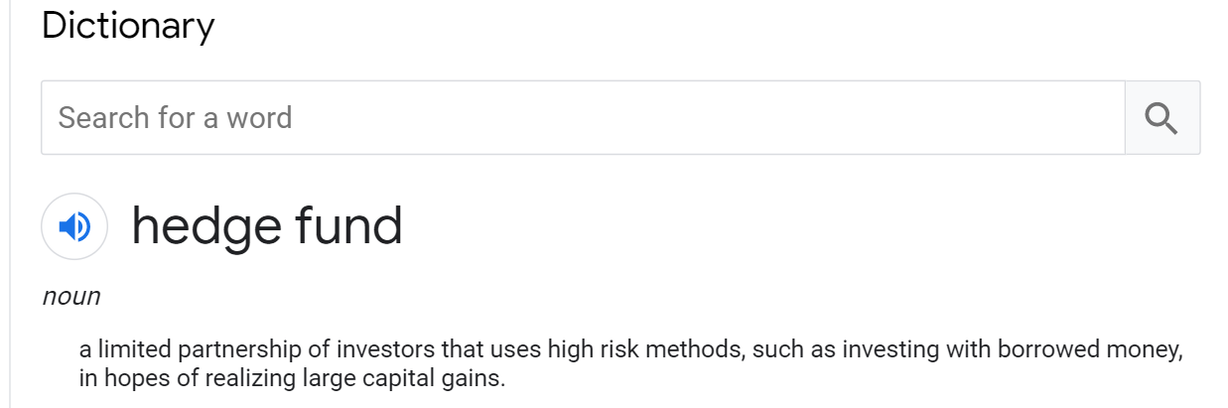

"Equal and Opposite Reactions" http://amzn.to/2xvcgRa and the sequel, "Hail Mary" https://www.amzn.com/1684334888 Buy them on Amazon. I DON'T GET SHORTING...Continued from yesterday: Over the past several days I have read more than half-a-dozen articles on the backfiring of the Wall Street hedge fund shorting of GameStop shares. I still don't get shorting. Or short selling, as is its text book nomenclature. It didn't help that most of the articles described shorting as "betting against a stock" without explaining what "betting against a stock" means. (I picture a a big electronic board upon which rows of colorful little fiber optic horses race against each other while on the floor below traders stand shoulder-to-shoulder shouting and cheering on their horses to lose because they've bet against them. For all I know, maybe that's what shorting actually involves). Anyway, the general message I took away was that if you don't know what shorting a stock means, then you don't need to know. That being said, I did come across a couple of finance sites that were more forthcoming with the nuts and bolts of short selling stocks, and here's what I've been able to gather: The hedge funds are the outfits that arrange for the short selling. From a site called Investopia I learned that "one way to make money on stocks for which the price is falling is called short selling (or going short). Short selling is a fairly simple concept—an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Short sellers are betting that the stock they sell will drop in price. If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the lender. The difference between the sell price and the buy price is the profit (for short-seller)." (1) And from The Motley Fool website I picked up that "the biggest risk involved with short selling is that if the stock price rises dramatically, you might have difficulty covering the losses involved. Theoretically, shorting can produce unlimited losses -- after all, there's not an upper limit to how high a stock's price can climb...If you lose too much money, your broker can (force) you to (buy) back the shares (and return them to your lender) at what could prove to be the worst possible time." (2) The above is what apparently happened to the hedge funders who had shorted the GameStop shares: The Robinhood app traders (see yesterday's post) communicated with each other, bought GameStop shares en masse, drove up the price of the shares by 1700%, made some money and left the short sellers owing a whole lot of money to the people, corporate entities, finance bots, money machines, or who- or whatever lent them the shares. In short (I think): 1. Joe has shares of stock worth $100 a share. 2. You borrow ten shares - that would be $1,000 worth - from Joe. 3. You sell Joe's ten shares. You put the $1,000 in your pocket. 2. You sit tight and wait for the price of the stocks you bought from Joe to drop on the stock market. 3. When the price of the stocks has dropped from $100 a share to $5 a share you buy back ten shares - the number you borrowed from Joe - for $50. 4. You then return Joe's ten shares to him for their current worth, which is $50. 5. You make $950 on the deal. 6. Joe makes negative-zip. Get it? No, me neither. Why the heck would Joe lend you stocks in the first place, knowing that your plan is that when you return his stocks they'll be worthless? What's in all this for Joe? (Would you lend someone your bike knowing that they were planning on selling your bike to a chop shop and bringing you back the handlebars?) Unless, of course, Joe knows something that you don't know. Like maybe that that GameStop stock might actually come crashing up, up, up from the basement and through the roof and leave you owing him the price of the stocks that are now worth not the hundreds of dollars they were when you borrowed them, but millions? I think maybe I do get the idea of shorting after all: References:

1. https://www.investopedia.com/ask/answers/how-does-one-make-money-short-selling/#:~:text=Short%20selling%20is%20a%20fairly,sell%20will%20drop%20in%20price.&text=The%20difference%20between%20the%20sell,buy%20price%20is%20the%20profit. 2. https://www.fool.com/investing/how-to-invest/stocks/how-to-short-stock/#:~:text=When%20you%20sell%20the%20stock,some%20time%20in%20the%20future.

0 Comments

Leave a Reply. |

"Tropical Depression"

by Patti Liszkay Buy it on Amazon: https://www.amazon.com/dp/B0BTPN7NYY "Equal And Opposite Reactions"

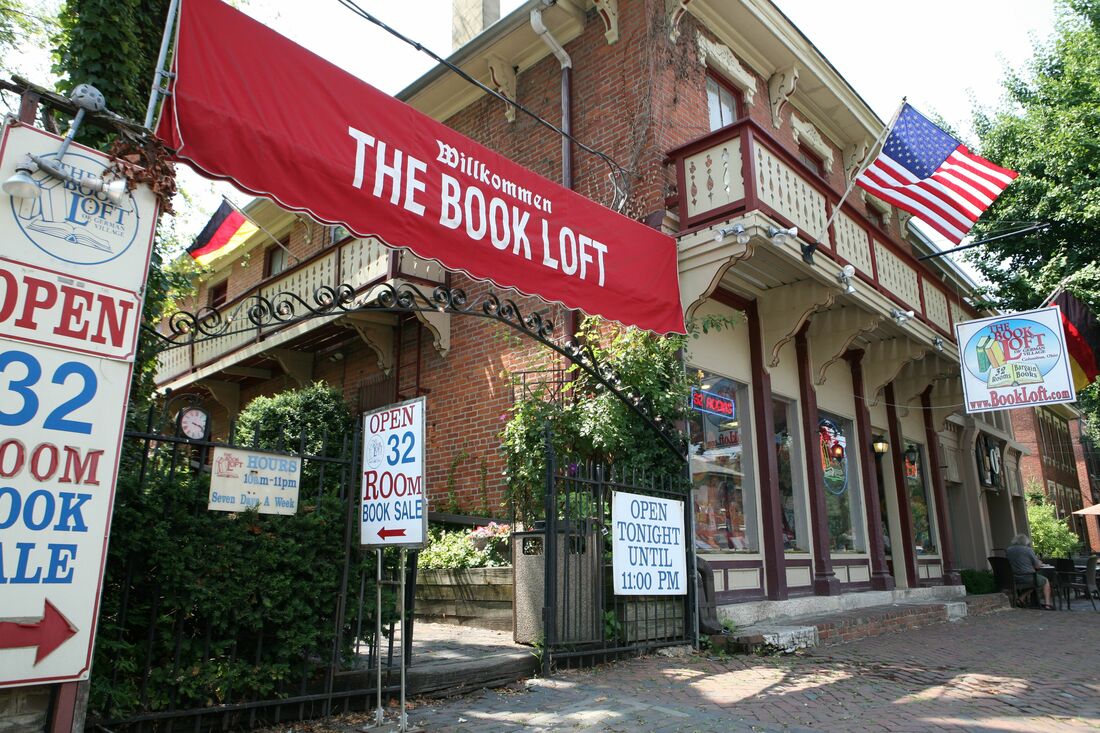

by Patti Liszkay Buy it on Amazon: http://amzn.to/2xvcgRa or from The Book Loft of German Village, Columbus, Ohio Or check it out at the Columbus Metropolitan Library

Archives

July 2024

I am a traveler just visiting this planet and reporting various and sundry observations,

hopefully of interest to my fellow travelers. Categories |

RSS Feed

RSS Feed